Did You Lose Large Amounts Of Money in Investments?

Our Securities Attorneys Assists Individual Investors Who Have Suffered Losses

Many people invest in stocks and other financial securities to save for retirement and other objectives. Securities are very complex, so it is natural to trust financial advisers, brokers, or other finance professionals to properly invest your money in line with your goals and risk tolerance. But if you have suffered large financial losses, you may be unsure whether it was bad luck or bad advice that caused you to lose your money. An experienced securities lawyer who focuses on helping individual investors can help you discover the truth. Securities fraud is real and something that unscrupulous financial professionals and investors use to their advantage. Unsuspecting investors and shareholders are the ones who suffer from securities fraud. They don’t have any special information and are not trying to manipulate people. These are honest, hard-working folks that are building something for the future. They are investing their money to reach different goals for themselves and their family. These people turn to financial professionals for help and guidance in making the best decisions. The problem is that securities fraud ruins confidence in the financial markets. Many investors will see the markets as rigid and never believe there is any chance they can make money. This is from significant losses that wipe out their retirement and trading accounts. This has adverse effects on their ability to plan and build for the future. Learn how an experienced securities fraud lawyer can assist in recovering your losses across various locations. Securities fraud is illegal under the Securities and Exchange Act of 1934. It bans this practice among Wall Street professionals and traders. Despite the illegality, securities and investment fraud continues. Many times, you don’t know what is happening until it is too late. You aren’t sure what to do or who to go to that can help.Our Securities Attorney Will Address Your Investment Concerns

If you have lost substantial money in an investment and are unsure what happened, our securities attorney can review your situation and help you find out. If it appears that you were the victim of intentional misconduct, or even unintentional negligence, we’ll advise you about potentially recouping your money through a legal claim.Our securities fraud lawyer at the Wolper Law Firm, P.A. is on your side. We have a 99% success rate of suing for securities and investment fraud. You have rights, and your financial professional has to make certain disclosures to you. Our team can help you to go after those responsible. Contact us today at 954.406.1231 / 800.931.8452 to get your free consultation.

Are You Suspicious About Your Broker?

Common Warning Signs of Securities Fraud and Negligence

The securities market naturally fluctuates, so if an account is showing losses, it does not automatically mean you have been the victim of securities fraud or negligence. However, if you are seeing large losses that cannot be explained, securities misconduct could be the reason. Pay attention to these warning signs:- A sudden, large, and unexpected loss in your portfolio

- Transactions you do not recognize and did not authorize

- Many frequent trades that your broker cannot explain

- The overall market is on a high, but your accounts are losing a great deal of money

- Your broker is not returning your phone calls or seems otherwise disinterested

- Your broker recommends very complex investments that you cannot understand

- Past investments your broker has recommended and placed you in are all losing money.

How Do You know if Securities Fraud is Taking Place?

You will see many different signs that indicate fraud is occurring, including:- Exaggerated claims: Your financial professional will try to talk up the investment. They will state that you will get a much higher return.

- Risk-free: Many times you will hear how there is no risk and you can’t lose any money. There is no specific backing such as FDIC insurance on the investment.

- Guarantees: You will hear guarantees about how you will get a great return and never lose any money. This is to convince you that the scheme is safe.

- Must do the deal right now: You must invest right now to take advantage of this great opportunity. There is no chance for you to think about it or do your homework.

What Does a Securities Attorney Do?

Securities attorneys provide counsel and representation in matters related to the securities market. Securities include stocks, stock options, bonds, mutual funds, exchange-traded funds and other financial assets and instruments. Some securities lawyers advise corporations, small businesses and brokerage firms about securities law and staying in compliance with U.S. Securities and Exchange Commission regulations. The SEC is the federal agency tasked with enforcing securities laws to protect investors. Securities attorneys for brokerage houses also defend their clients against claims of misconduct and negligence by wronged investors. Our securities attorney focuses exclusively on helping individual investors who have lost money in the market and believe they were wronged by their financial advisers or brokers. When financial losses are due to misconduct, fraud or negligence, our hardworking attorney painstakingly pursues legal claims for recovery on behalf of clients. As a former securities litigation lawyer who spent nearly 15 years defending the brokerage firms that he now sues, our attorney is exceptionally qualified to help aggrieved investors recoup losses. His dedication to helping investors get their money back is further exemplified by his membership and participation in PIABA, an international bar association for attorneys who represent public investors in securities disputes.How Do You Know If You Need a Securities Lawyer for Investment Losses?

Every investment carries risk — some carry more risk than others. When you invest in the securities market and lose money, it doesn’t necessarily mean that your financial adviser or stockbroker did anything wrong. You cannot bring a legal claim against your adviser or broker simply because you are upset about an investment loss. However, if you believe your adviser was guilty of misconduct, fraud, or even unintentional negligence, you may have a legal claim. Our securities lawyer for investment losses can help you discover whether you have a claim by examining your account statements, communications with your adviser and other evidence. Do not hesitate to reach out to our law firm if you believe you were wronged by an investment adviser or brokerage firm. We deliver personalized and responsive service and can be reached seven days a week online or by calling 954.406.1231 / 800.931.8452.Frequently Asked Questions About Securities Law

Contact Us Directly With Specific Concerns

Following are answers to common questions about securities law. To have your questions answered about your individual case, contact our law firm.

There are both federal and state laws intended to protect investors. The federal Securities Act of 1933 prohibits fraud in the sale of securities and requires that investors receive financial and other information about public securities offerings. The Securities Exchange Act of 1934 created the SEC and gave it power to regulate and discipline brokerage firms and their agents. You can read about additional federal laws that govern the securities industry here.

States also have their own laws to protect investors. These laws are known as “blue sky” laws. While these laws vary between states, in general they require companies to register the securities they offer, and they also license financial advisers, brokerages and brokers.

Unfortunately, securities and investment fraud are more common than most honest people would like and expect. Recent statistics from FINRA show that the organization referred nearly 1,000 cases of fraud and other misconduct for criminal prosecution in a single year. That same year, it barred nearly 250 brokers from trading and suspended 375 more. You can see how prevalent misconduct is in the securities trading industry. If you suspect your broker or financial adviser of committing misconduct that cost you money, call us for help today.

It can happen for a number of reasons. It can be due to the greed of financial advisers and brokers who intentionally commit fraud to line their own pockets. With the securities industry being as complicated as it is, it can be easy for dishonest brokers and advisers to hide what they are doing. Besides intentional fraud, negligence by financial professionals can also cost investors money. A broker or adviser may be lazy in handling their clients’ portfolios or they may not have proper understanding of securities investments themselves and provide poor advice. In any case, when negligence or misconduct costs trusting investors money, those who commit it should be held accountable.

Brokers and financial advisers who commit fraud or are negligent may lose their professional licenses and certificates to work in the securities industry. They may also face large fines. The same goes for brokerages and financial planning firms. Individuals who are found guilty of investment and securities fraud may also be criminally prosecuted and have to pay criminal fines and potentially serve jail or prison time. The United States Sentencing Commission reported that in 2020 approximately 120 securities and investment fraud offenders were sentenced to prison, with an average sentence of 46 months.

Recovering Investment Losses through Arbitration Or Litigation

Depending upon your circumstances and the details of your securities accounts, you may be eligible to bring your claim before an arbitration panel or litigate your case in civil court.FINRA Arbitration

The Financial Industry Regulatory Authority (FINRA) is a United States government-authorized organization that oversees the country’s brokers and brokerage firms. FINRA and the SEC can hold brokers and financial advisers accountable for misconduct through fines, license suspensions and other means. Additionally, most claims from securities investors to recoup money lost to broker fraud are resolved through the FINRA arbitration process rather than in civil court. The reason for this is that most brokerage firms include arbitration clauses in their customer agreements. If you’ve signed an agreement that includes an arbitration clause, you are most likely bound to have your claim decided by FINRA arbitrators. Even if you believe you lost money to fraud in the past, you may still be eligible for arbitration. Investors have up to six years from the date that the investment fraud occurred to file a FINRA arbitration complaint. In arbitration, independent arbitrators hear the evidence and arguments from both sides and then make binding decisions. A binding decision means that the arbitrator’s decision is final and cannot be appealed, unlike in a civil court case. If the decision goes in your favor, the adviser or broker who committed misconduct will have 30 days to pay you your financial award. Our securities attorney is allowed to arbitrate FINRA cases nationwide. So, no matter what state you live in, if your claim is eligible for FINRA arbitration, our law firm can help you. You may also be able to try and settle your claim through FINRA mediation rather than arbitration if the broker and/or the brokerage firm agrees to mediation, which is voluntary. Our attorney can represent your interests in mediation as well.Securities Litigation

If you are not bound to arbitration, you may have the option of suing the investment adviser or other securities professional who wronged you in civil court. A court case can often take longer than arbitration because decisions can be appealed. Depending upon your situation, you may wish to bring an individual lawsuit or participate in a securities class action suit if there are multiple violations related to the security offering. To recover investment losses for our clients who have been victimized by unscrupulous financial advisers, our securities attorney is ready, willing, and able to take cases through the trial phase.Reach Out to a Diligent Securities Lawyer

Once we learn all the details of your case, we’ll advise you about the paths to financial recovery that may be available to you. Call our securities lawyer today to arrange a free, no-obligation consultation at 954.406.1231 / 800.931.8452.

Safeguard Your Investment Money

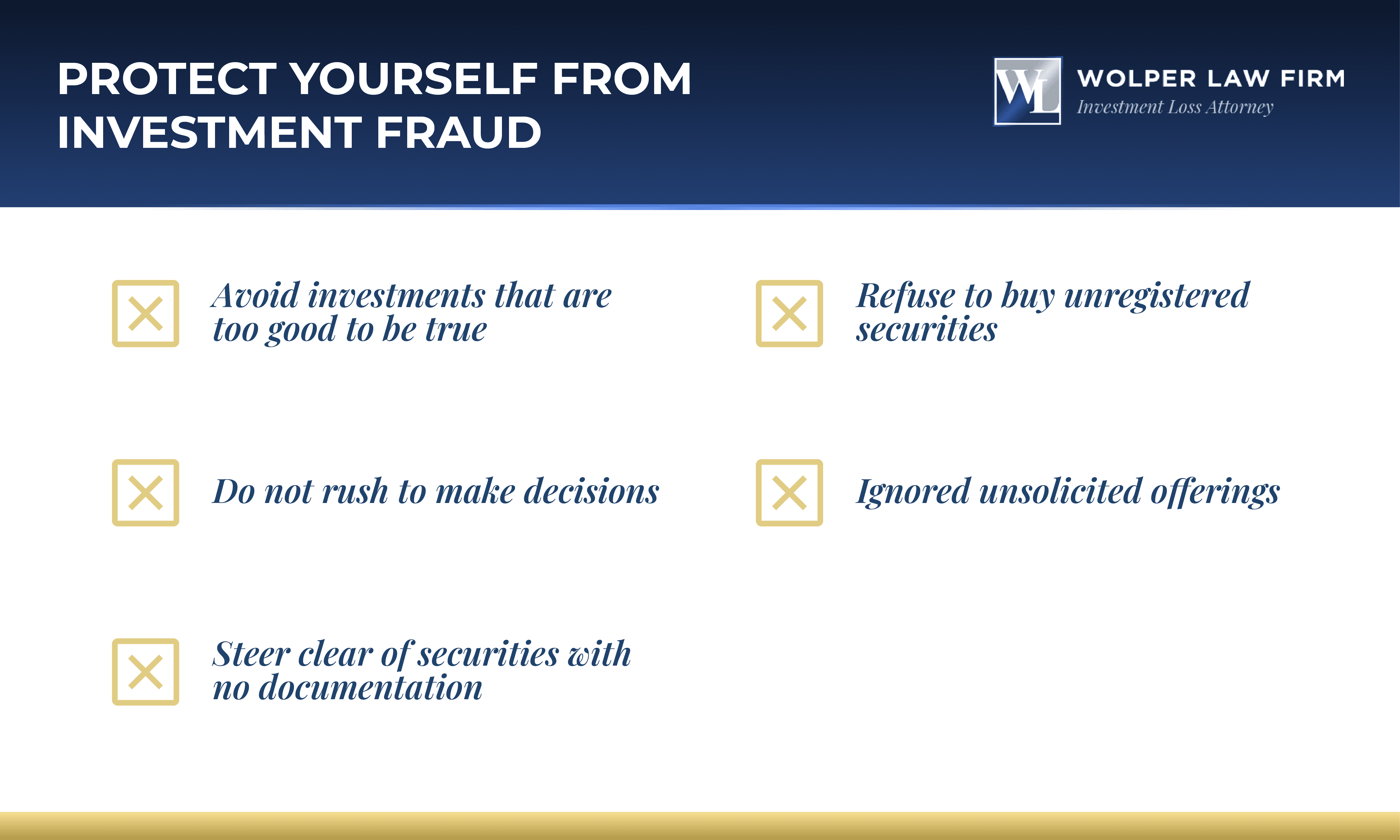

Work with Reputable Financial Advisers and Brokers It pays to know who you are trusting with your securities investment money. You can check broker, brokerage firm and financial adviser credentials by visiting: You can further protect yourself from becoming a victim by taking some commonsense precautions that include:- Saying no to investment opportunities that sound too good to be true

- Not allowing yourself to be pushed into quick investment decisions

- Walking away from securities that don’t have documentation

- Not buying unregistered securities

- Ignoring anyone who contacts you with an unsolicited securities offering.

Contact Our Experienced Securities Lawyer for Fraud Cases

To begin the process of holding accountable the individual or company that caused your investment loss, schedule a free confidential consultation with Wolper Law Firm, P.A.. Our securities attorney stands up assertively for the rights of defrauded investors.Contact us today at 954.406.1231 / 800.931.8452 if you suspect you are the victim of securities or investment fraud.We look over your situation and will tell you what is happening. Our team of skilled litigators practices in securities law and we have decades of experience. We will find out what happened and will help you to sue for investment fraud. Our securities fraud lawyers have a 99% success rate and will work with you to sue for your losses. You have rights, and we will stand up and fight for you. Investment fraud is illegal, and you want someone on your side who knows what to do.

Client Testimonial

”I found The Wolper Law Firm, P.A. to be excellent. Very clear on what the process was, good communication and advice. I am extremely grateful I was referred to Matthew Wolper.” – Cynthia S (Google Review)

Matt Wolper is a trial lawyer who focuses exclusively on securities litigation and arbitration. Mr. Wolper has handled hundreds of securities matters nationwide before the Financial Industry Regulatory Authority (FINRA), American Arbitration Association (“AAA”), JAMS, and in state and federal court. Mr. Wolper has handled and tried cases involving complex financial products and strategies ranging from traditional stocks and bonds to options, margin and other securities-based lending products, closed/open-end mutual funds, structured products, hedge funds, and penny stocks.

[

Matt Wolper is a trial lawyer who focuses exclusively on securities litigation and arbitration. Mr. Wolper has handled hundreds of securities matters nationwide before the Financial Industry Regulatory Authority (FINRA), American Arbitration Association (“AAA”), JAMS, and in state and federal court. Mr. Wolper has handled and tried cases involving complex financial products and strategies ranging from traditional stocks and bonds to options, margin and other securities-based lending products, closed/open-end mutual funds, structured products, hedge funds, and penny stocks.

[